“A Long-Despised and Risky Economic Doctrine Is Now a Hot Idea”

MMT und Helikopter erreichen immer mehr den Mainstream. Passend zum Thema “Klimawandel” werden so die nächsten Extremmaßnahmen in der Geldpolitik vorbereitet. So befasst sich auch Bloomberg mit dem Thema:

- “Hardly anyone thinks central banks can fix a stalling world economy with their current tools. So some of the biggest names in finance are trying to invent new ones. The proposals so far – including recent entries by billionaire Ray Dalio and monetary policy maven Stanley Fischer – have one thing in common: They foresee the once all-powerful central bankers taking a more junior role, and collaborating with governments.” – bto: richtig. Es geht darum, die Nachfrage um jeden Preis hochzutreiben und damit auch die Inflation, damit der Nenner endlich schneller wächst als der Zähler! Ich bin auch dafür, ist doch die Alternative äußerst unerfreulich!

- “History is littered with cautionary tales in which blurring the lines between central bank and Treasury coffers led to runaway inflation.But right now, deflation is the big threat. An emerging consensus says the next downturn may need to be fought with direct and permanent injections of cash – often called ‘helicopter money’ – and that central banks can’t deliver it alone.” – bto: Und warum ist Deflation so gefährlich? Weil es dann zum Kollaps der aufgeblähten Vermögenspreise und der dahinterstehenden Schulden kommt.

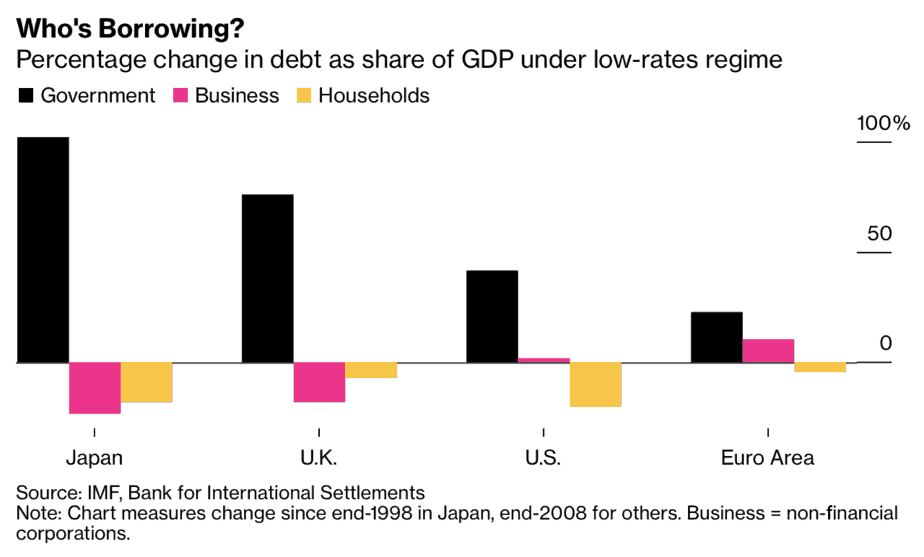

Interessant ist die Abbildung zur Entwicklung der Schulden nach Sektoren seit 2008 (Japan seit 1998). Die privaten Haushalte bauen Schulden ab, die Unternehmen auch (außer in den USA und in der Eurozone) und die Staaten machen mehr Schulden. In der Eurozone sicherlich nicht genug:

Quelle: IMF, Bank for International Settlements, Bloomberg

- “What’s resurfacing is the old idea of monetary policy sometimes pushing on a string, (…) We’ve got to think much harder, for economic stabilization, about mechanisms that involve spurring demand directly. (…) their budgets, governments don’t have to push the string – they can open the taps, spending directly into the economy or boosting the purchasing power of consumers or companies by cutting taxes.” – bto: So und nur so wird das funktionieren.

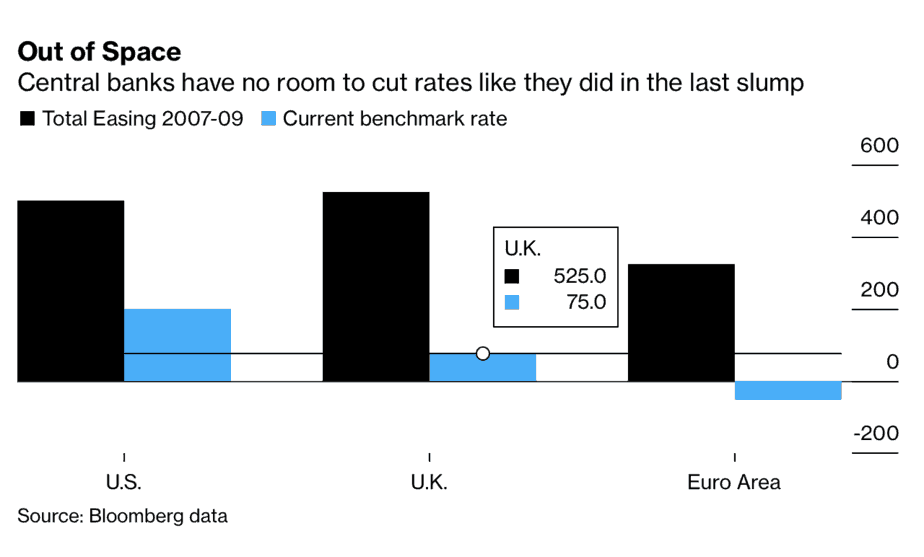

- “(…) fiscal-monetary cooperation (…) could solve problems, and maybe create some new ones (…) The banks would get their hands on some powerful new instruments. But they’d likely have to accept that independence from politicians (…) has limits.” – bto: Dazu zeigt Bloomberg dann ein interessantes Chart. Es zeigt (schwarz), um wie viel die Notenbanken in der letzten Krise die Zinsen gesenkt haben und wo sie heute liegen. Sie müssten also beim nächsten Mal deutlich in den negativen Bereich. Deshalb auch die Diskussion über Bargeldeinschränkung und -besteuerung.

Quelle: Bloomberg

- “One solution is to (let) central banks create money to finance government budget deficits. The challenge (…) is to encase such ‘historically unusua’ measures in explicit rules – so that central bankers retain their independence, and can apply the brakes if government spending gets out of control. (…) The details differ, but plenty of others have reached similar conclusions about what central bankers could do next (…) you need fiscal policies and debt monetization (…).” – bto: Das wird nur über eine Entwertung von Geld funktionieren können.

- “Along with the lack of monetary ammunition, one reason behind the big rethink may be deepening inequality, especially after 2008’s financial crisis. As central banks shifted from setting rates to seemingly propping up financial assets, they became more vulnerable to the charges that their policies helped the rich most, and went beyond their remits. A new book by financial commentator Frances Coppola, titled ‘ The Case For People’s Quantitative Easing,’ calls for newly minted central-bank money to be funneled straight into the bank accounts of households or small businesses. That kind of stimulus will deliver more growth and better distribution, she argues — as well as addressing challenges like ageing populations and automation.” – bto: Ich finde diesen Gedanken nicht schlecht, habe ich doch schon vor Jahren genau das vorgeschlagen: 10.000 Euro für jeden.

- “After the 2008 crash, central banks routinely worked with governments. (…) But if the post-crisis environment has strengthened the theoretical case for working together, in practice it’s often led to unusually fraught relations between politicians and technocrats. (…) It’s in Japan that collaboration has been taken furthest. The Bank of Japan has been a key player in Prime Minister Shinzo Abe’s plan to reflate the economy with a mix of monetary stimulus and fiscal spending. It now holds 43% of the national debt, which is the world’s largest.” – bto: Wobei man kritisch anmerken müsste, dass die Inflation immer noch recht tief ist. Auch das Wachstum ist mau, allerdings wächst die Produktivität pro Erwerbstätigen eindrucksvoll, was aber eher an Technologie und Innovation liegt, statt am billigen Geld. Oder?

- “In theory, that debt hasn’t been monetized. In reality, most analysts think it has, and the sky hasn’t fallen in. The market does not expect the government of Japan to ever be able to repay this debt, (…). The BOJ may as well make it explicit.” – bto: Richtig, offiziell die Schulden annullieren, wäre jetzt der konsequente nächste Schritt. Und der wird gegangen werden.

- “Japan was the first country to cut interest rates to zero, and the first to try quantitative easing. Given its close working relations with the government, the BOJ may provide a blueprint for the latest ideas about central banking too.” – bto: Und das sehe ich genauso.