Zehn Jahre Bullenmarkt – aber die Aktien sind in keiner Blase?

Gavyn Davies wirft einen Blick auf den Bullenmarkt der letzten zehn Jahre (zumindest an der Wall Street) und fragt, was man aus der guten Entwicklung für die Zukunft schließen kann:

- “Since March 2009, US equity prices have risen by 12.5 per cent per annum, and most global stock markets have joined the party. What caused this phenomenal rise in risk assets and what does this tell us about the future?” – bto: Ich würde sagen, wir kennen beide Antworten. Das billige Geld und dass es nicht gut ausgeht. Aber vielleicht kommt Davies ja zu einem anderen Schluss?

- “Many commentators are extremely suspicious (…) They argue that the rise in asset prices has been driven by ‘artificial’ monetary stimulus by the central banks, especially quantitative easing. The implication is that when monetary policy returns to normal, asset prices will implode. According to them, not even the Federal Reserve can inflate an asset price ‘bubble’ forever.” – bto: Ich hätte mich zu diesen Skeptikern gezählt.

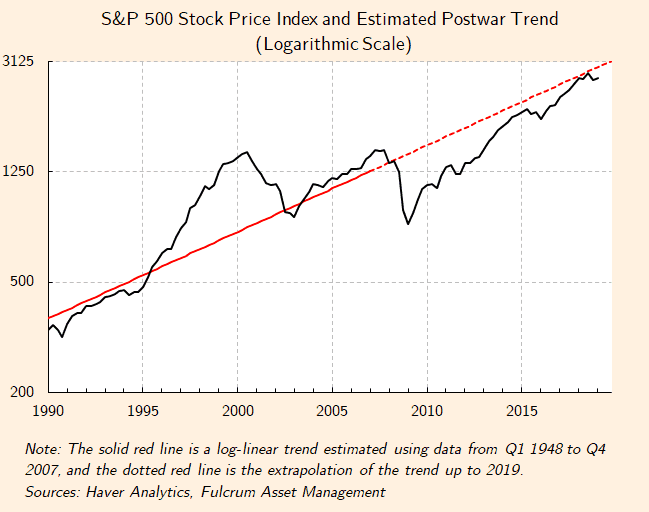

- “Equity prices have not risen above their long-term rising trend lines, even at the recent extremes (see graph). At the start in March 2009, US equity prices were 60 per cent below their long-term trend line. A decade later, equities have risen sharply, but are still 9 per cent below trend. In this basic and rather ‘naive’ model, there is no prima facie case for arguing that the stock market is in a ‘bubble’.”

Quelle: FT

Jetzt würde ich natürlich sagen, dass der Trend letztlich vom Wirtschaftswachstum getragen wird und da haben wir doch eine Verlangsamung erlebt, während gleichzeitig die Bewertungen auch wegen der tiefen Zinsen immer weiter nach oben gegangen sind?

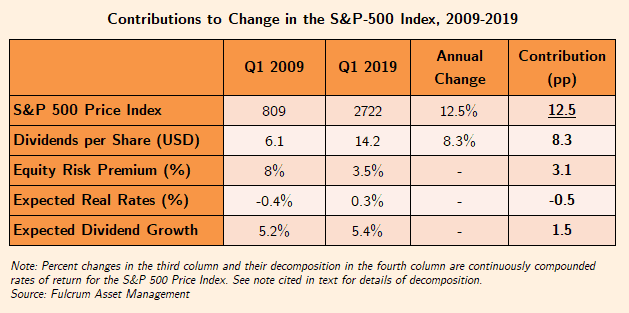

- “We can analyse the behaviour of asset prices more carefully by using a dynamic version of a standard relationship, known as Gordon’s growth (or dividend discount) model, which asserts that the change in equity prices over any given period can be attributed to changes in: Company dividends (or, sometimes, earnings); Expected future dividend growth; The real risk free interest rate on government debt (one of the main factors driving bond yields); and the equity risk premium.” – bto: Das leuchtet alles ein.

- “The main contributor has been the rise in dividend payments, probably the most solid of all fundamentals. Higher dividends account for 8.3 percentage points of the 12.5 per cent annualised increase in equity prices since the trough of the bear market. The next largest contributor is the decline in the equity risk premium (ERP), which has contributed 3.1 percentage points to the bull market. The ERP is the expected excess return on equities relative to risk free interest rates, and is the compensation that investors require to hold riskier assets.”

Quelle: FT

- “If this had been decisive, declining real rates should have been a major contributor to the rally, but that seems not to have been the case. (…) Perhaps it can be argued that the two major contributors to the equity rally — higher dividends and a restoration of risk appetite — were in part due to easier monetary policy. That is plausible, but it does not indicate that monetary policy was too easy, or even that QE was artificially stimulative.” – bto: Also war es alles rein fundamental begründet und zudem sind Aktien ja noch unter dem Trend. Alles gut.

- “In fact, the behaviour of the US and global economy suggests that monetary policy from 2009-19 was, for the most part, too tight, not too easy. Since 2009, real and nominal GDP have fallen sharply below previous trend lines, and inflation has been persistently below central bank targets. These conditions are symptomatic of a shortage of demand, especially in the eurozone and Japan, despite stimulative monetary policy.” – bto: Das ist richtig argumentiert, wenn man glaubt, dass die Zentralbanken daran etwas ändern können!

- “(…) it is reassuring that, following the bull market, equity prices are still underpinned by fundamentals more solid than a mountain of paper money. Instead, the equity market is close to its very long-term trend. More important, equity valuation remains within normal bands, albeit towards the expensive end of the range for equities.” – bto: was sich nicht mit den Berechnungen anderer deckt. Ich erinnere an:

→ Rekordmargen und Rekordmultiples

→ GMO: magere Aussichten für die US-Börse

- “The model predicts that total US equity returns will be about 4-5 per cent per annum in nominal terms in the next three years — much lower than recently, but still positive. The great bull run may be over, but that does not mean that a great bear market will inevitably follow.” – bto: wie gesagt, es gibt auch andere Berechnungen

→ ft.com (Anmeldung erforderlich): “The great bull market reaches its 10th birthday”, 31. März 2019