Italien – die Zeit wird knapp

Ein Leser hat mich mit Bezug auf den Beitrag von heute Morgen darauf hingewiesen, dass die Italiener einen “Hang zu Verschwörungstheorien” haben, wie die NZZ gestern berichtete:

→ NZZ: “Der alles zerfressende Argwohn”, 6.Februar 2017

Viel konkreter ist da die finanzielle Lage des Landes. Nach einer neuen Studie wachsen die Kosten eines Euroaustrittes des Landes mit jedem Monat weiter an. Es wäre also Zeit, entsprechend schneller zu handeln, so der Tenor. Ich könnte das allerdings auch umdrehen: Angesichts eines neuerlichen Rekordstandes bei den Target2-Forderungen der Bundesbank ist es auch hier höchste Zeit, die Notbremse zu ziehen.

Doch nun zu der Studie bezüglich Italien:

- “A forensic report by Italy’s Mediobanca (…) lays out in minute detail why Italy is finally running out of road after eighteen years of economic depression and eurozone mismanagement. The awful possibility of a full-blown debt crisis in a country that is too big to save – and by now too angry to bully – must be faced head on.” – bto: Das ist keine Neuigkeit, ich denke aber, Italien wird die anderen – also vor allem Deutschland – erfolgreich erpressen. Wo wäre denn bei uns die Opposition? Frau Merkel kann keine neue Eurokrise gebrauchen und Herr Schulz ist prinzipiell für Schuldensozialisierung.

- “The report said the optimal moment to leave the euro has already passed – in narrow financial terms – and that it will become progressively more costly to do so as each year passes. Within four years it will become prohibitive.” – bto: Das gilt übrigens für alle Beteiligten. Aber Achtung, daraus zu schließen, weil es alle betrifft, käme es am Ende besser, ist für mich eine heroische Annahme!

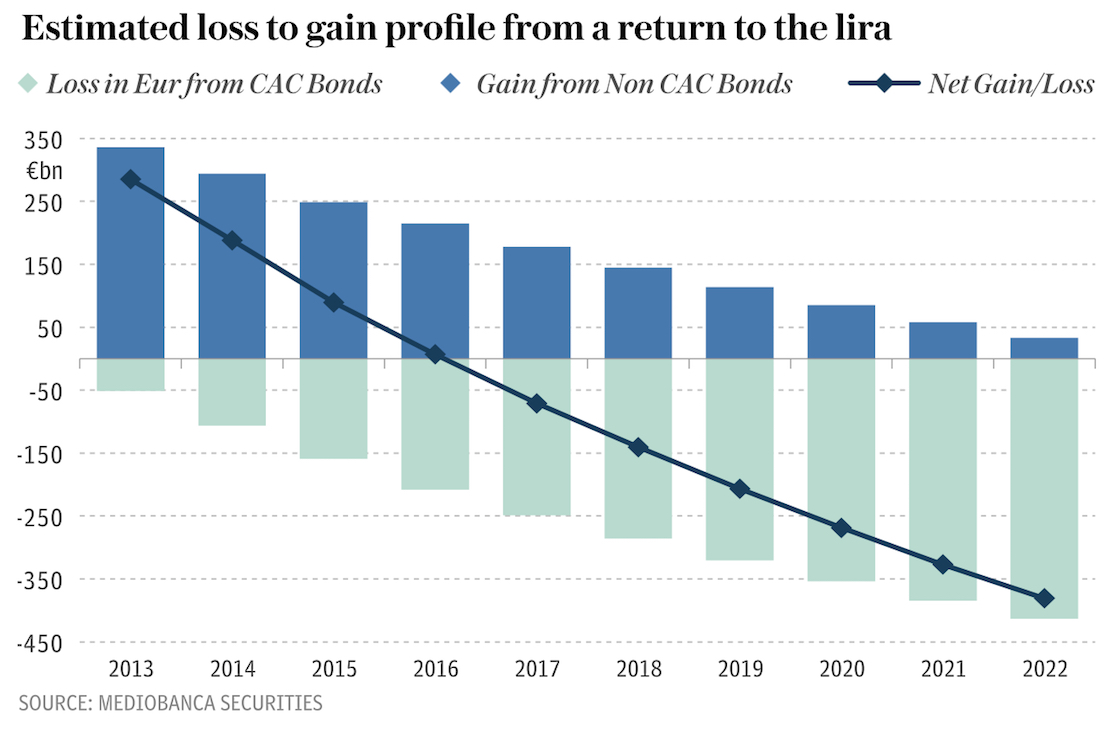

- “As of today, Italy can still switch half of its €1.9 trillion of traded sovereign debt to lira under the legal prerogative of Lex Monetae on roughly neutral terms, but the argument is that this calculus will shift as new debt with collective action clauses (CACs) displace the old bonds.” – bto: Wer glaubt ernsthaft, dass Italien (oder irgendein anderer Staat) sich im Ernstfall daran hält? Ich nicht.

- “Mediobanca’s argument on CAC debt clauses – agreed by EU leaders in December 2012 – is they that make it more difficult to ‘redenominate’ bonds from euros into lira. The litigation costs no longer make it worthwhile. As of late last year, the relevant bonds were evenly split. Italy had €932bn of old debt, and €902bn of new CAC debt. The contracts are migrating from one to the other at a pace of €200bn a year. Most of debt stock will be under CAC rules by 2022:”

Quelle: Telegraph

- “The European Central Bank will soon start to wind down its programme of bond purchases, while new rules on tangible equity will force Italian banks to slash holdings of government bonds by €150bn.” – bto: Die EZB wird nicht aussteigen. Sie macht immer weiter, mindestens so lange, bis Italiens Schulden bei ihr liegen. Alles andere ist Blabla.

- “The ECB system has already bought €210bn of Italian debt. This covered the entire budget deficit last year and covered the roll-over of old bonds as others pulled out. “Tapering will leave the Italy without the key buyer of its debt,” said the report.” – bto: Wie gesagt, das wird nicht passieren. Alle wollen, dass es weitergeht.

- “Italy’s creditors will then face a choice: do they offer debt-restructing on friendly terms within monetary union, or do they hold out and wait for the political storm sweeping Italy to smash the eurozone system.” – bto: Das ist theoretisch richtig, aber vorerst nicht zu befürchten.

- “(…) voluntary debt exchange is the cleanest way to put Italy’s debt on a ‚sustainable path‘ (…). Without these changes, the debate regarding a unilateral exit from the eurozone and a consequent return to the lira looks likely to gain momentum based on the political situation on Rome.” – bto: Also, entweder die EZB kauft oder Italien macht Pleite bzw. tritt aus. Wer glaubt wirklich, dass die EZB nicht kauft?

- “The genie is out of the bottle. Every talk show in Italy is openly discussing whether or not to leave the euro. It is escalating by the day, and sooner or later the market is going to move.” – bto: siehe Kommentar von heute Morgen.

- “Mediobanca said the ECB’s various schemes (LTRO lending, QE) have essentially financed ‚capital flight‘ from Italy, and allowed North European banks to extract their money. The risk has been switched to the eurozone taxpayer, again, a la Grecque. Over €220bn has left the country and ended up in mutual funds in Germany, Luxembourg, and Holland. This slow break-up of monetary union shows up in the Bank of Italy’s liabilities to the ECB in the Target2 payments system, now a record €359bn.” – bto: “Eurozone Taxpayer”?? Deutsche Taxpayer!

- “Whether or not Italy would in fact owe such Target2 sums is hotly contested. The ECB has until now always rubbished any suggestion that these vast sums (Germany has €754bn in credits) are a stealth bail-out or involve real money. Suddenly Target2 is no longer Monopoly paper after all.” – bto: Das war es doch nie!

- “Mediobanca’s calculations on gains and losses from leaving the euro are based on the premise that the lira would fall by 30pc. (…) Mr Borghi argues that the euro would in fact disintegrate. The drachma and the escudo would plummet. The D-Mark and the guilder would rocket. The franc and the lira – or the new Medici ‘Florin’, as he calls it – would weaken to varying degrees but not by anything close to 30pc in pan-EMU terms.” – bto: weshalb man sich darauf vorbereiten muss! → „Was wäre wenn der Euro platzt?“

- “There has been no rise in per capita income for eighteen years. Industrial output has dropped back to the levels of the early 1980s. The economy is still 7pc smaller than it was before the Lehman crisis. Two lost decades threaten to become a third. It is worse than anything ever suffered before by a developed economy in peacetime.” – bto: Das liegt natürlich nicht nur am Euro, dennoch.

- “The elemental failure of policy elites in Europe and Italy is that they ignored all the warnings from currency theorists – and indeed ignored from the historic North-South divide that blighted Italy’s internal lira union after the Risorgimento, which should have been a salutary warning.” – bto: bingo.

→ The Telegraph: “The cost of leaving the euro is rising every month for Italy”, 1. Februar 2017