Irving Fishers Debt-Deflation ist schon da – wir merken es nur nicht!

Bekanntlich bin ich ein großer Fan von Irving Fishers “Debt-Deflation Theory Of Great Depressions”. Charles Gave ist dies auch und er führt in diesem Beitrag ausgesprochen interessant aus, dass wir wohl schon mitten drin stecken:

- “The main point of this fascinating work is that if an economy suffers simultaneously from over- indebtedness and falling prices, then strange things start to happen. These include a fall in the velocity of money and a collapse in capital spending.” – bto: Wer es noch nicht kennt, sollte das Originalpaper unbedingt lesen.

- “And when it comes to interest rates, Fisher explained that things get really tortuous, with falling nominal rates, rising real rates, and a marked widening in the spread between high quality credits and less reputable names.”

- “The complicating factor is the nature of price changes. To calculate real interest rates, it is necessary to use some form of inflation figure. Historically, I have used the consumer price index, or the personal consumption expenditure index, or the PCE ex-shelter, or the PCE ex- food and energy. But whichever measure I have taken, I have always used an average rate across the whole economy.”

- “This may not have been the best approach. Let me explain why. If we accept that the US private sector consists of two components, one which produces services and one which turns out goods, then we find that historically inflation in the services sector has averaged around 2.5% a year. In contrast, inflation in the goods sector has averaged 0.4%, with prices that have actually been in decline for roughly half the time since 2000.” – bto: eigentlich bekannt. Habe aber auch nicht groß daran gedacht. Übrigens gibt es gerade bei uns “administrierte Preise”.

- “(…) I have failed to take this divergence into account, relying instead on broad whole-economy inflation rates, which are typically some form of weighted average of the rates in each sector. This approach may have been misleading.”

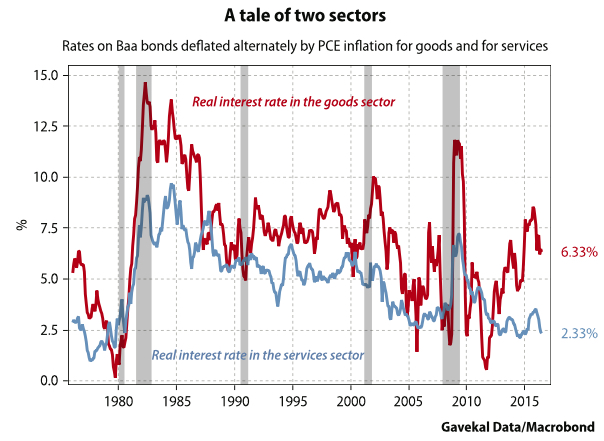

- “To see why, take a look at the chart , which shows two versions of the real interest rate — in this case the rate on Moody’s Baa-rated seasoned long-dated industrials — the first calculated using the PCE inflation rate in the services sector, and the second using the rate in the goods sector:

- As you can see, if I use service sector inflation, then the real interest rate on Baa bonds is just 2.3%—very close to its lowest level since 1979. But if I use goods sector inflation instead, then the real rate is not only painfully high at 6.3%, it has also been trending higher, even as nominal rates have been heading lower.” – bto: was natürlich für die Schuldner absolut tödlich ist.

- “In other words, it looks as if the goods-producing segment of the US economy may be caught in a classic Fisherian trap, in which nominal interest rates are falling, but real interest rates are rising.” – bto: und wie.

- “The severity of such a trap depends on whether the sector in question is overly indebted. According to Fisher, if prices are falling then the ‚real‘ value of the debt that a company has to repay rises over time, making life more difficult for borrowers.” – bto: weshalb wir genau das in China sehen und China Deflation in die Welt exportiert.

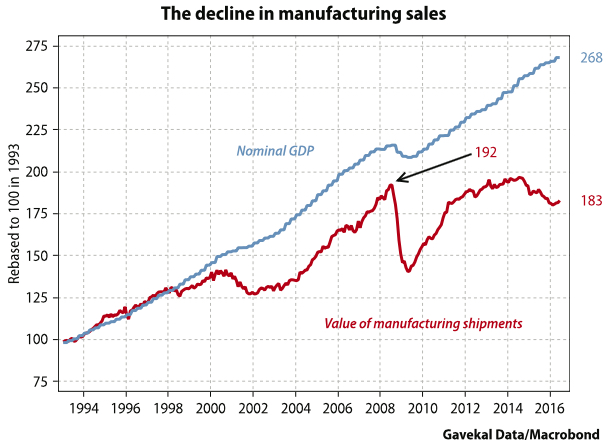

- “Notably, the US manufacturing sector has had falling sales for the last couple of years, which makes servicing debt more difficult, and principal repayment next to impossible.” – bto: was den deflationären Trend verstärkt, weil man nicht wegen Gewinn, sondern wegen Liquidität verkauft.

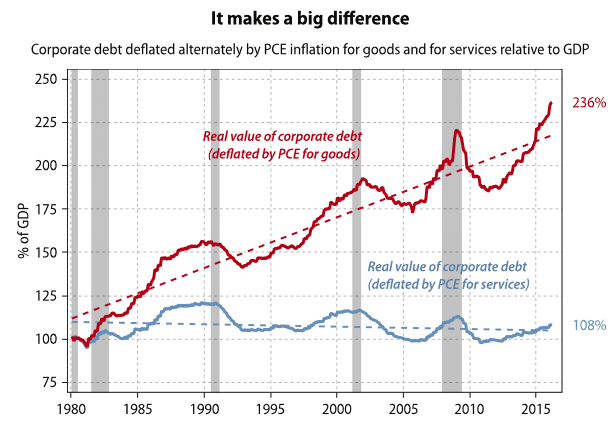

- To illustrate the effects of diverging inflation rates on debt, the chart below shows the value of US corporate debt, deflated first by the services PCE and second by the goods PCE, relative to GDP at constant prices.” – bto: Das Bild ist eindrücklich!

Quelle: Gavekal

- “Deflated by the services PCE, corporate debt relative to GDP is only slightly above where it was in 1980. There is no directional trend, and since the real interest rate for the services sector is close to its long term low, there is no pressing need to worry either about principal repayment or servicing costs.”

- “But deflating by the goods PCE tells a very different story. Relative to GDP, the trend is firmly upward. And the real size of America’s corporate debt now stands at a record 236% of GDP, which implies that companies could face great difficulty meeting both interest and principal payments— unless the Federal Reserve starts buying corporate debt.” – bto: wobei ich nicht sicher bin, was das bringen soll bei sechs Prozent Realzinsen … Da müssen die Zinsen schon sehr negativ sein.

- “The chart below illustrates the problem further. Since 2008, nominal GDP has grown by 24%. Over the same period, the US manufacturing sector has seen a -5% fall in its sales, even as its debts have been going up both in nominal and in real terms.”

- “With rising debt and falling sales, manufacturing sector bosses must be engaged in a mad dash to maximize the amount of liquidity on their books and investing that liquidity in the safest possible cash deposits. Fisher warned what would happen in this situation: companies would stop investing, stop hiring, and start firing left right and centre. They would try to sell assets or to establish cartels with their competitors. And if they could, they would replace short-term debt with very long-term debt.”

- “I suspect that the same situation prevails in the eurozone, in China, and in Japan. Clearly it would be misguided to expect increases in capital spending anywhere as long as real rates for goods-producing companies are north of 6%. Who is going to borrow at 6% when sales are falling by -3% each year? Nobody. The only rational decision is to repay your debt or to extend its duration as much as possible.”

- “(…) central banks should buy corporate debt, just as the European Central Bank has started to do. We should see more such buying. The alternative would be deep currency devaluations. The trouble with that solution, of course, is that devaluation is a zero sum game.” – bto: Das ist aber die Angst vor China. Wenn die es probieren, wird die Deflationsspirale für alle tödlich.

Fazit Gavekal: “(…) the present situation is clear: the world’s industrial system is in deflation, and could move into Fisherian debt-deflation at any time. If that happens, it would be surprising if it had no impact on the service economy. In the meantime, it seems reasonable to look for heavily indebted industrial companies — especially ones with a large portion of their debt maturing in the next couple of years and operating in economies with overvalued exchange rates — to sell short. And remember, when debt-deflation hits the world, banks seldom do well (…).”

bto: In einer Debt-Deflation will man weder Schuldner, noch Gläubiger sein. Besser Assets ohne Kontrahentenrisiko.

→ Gavekal: “Irving Fisher, Debt-Deflation And The Bifurcated US Economy”, 12. August 2016