“Global reflation: still weak and patchy”

Heute Morgen haben wir diskutiert, ob der Welt nun der Margin Call bevorsteht. Steigende Zinsen, die dem Spiel auf Zeit mit immer mehr Schulden ein Ende bereiten. Wichtige Voraussetzung ist dabei ein Anstieg der Inflationsraten. Ist der realistisch? Gavyn Davies ist in der FT vorsichtig. Aus seiner Sicht spricht noch nicht viel für die Reflation.

- “The great global disinflation in the advanced economies started in 1982, flattened in the 1990s and 2000s, and then nosedived towards deflation as commodity prices collapsed in 2014-15. For much of that final period, deflation fears dominated global bond markets and, to a lesser extent, equities and other risk assets. But there have been signs during 2016 that markets have edged away from a regime of “deflation dominance”, and we have seen partial signs of reflation.” – bto: was natürlich sehr viel mit der Ölpreisentwicklung und dem Sockeleffekt zu tun hat.

- “There are signs that the risk of outright deflation is falling and, in some parts of the developed world, core inflation has edged higher. (…) Very recently, even the Eurozone markets have been drawn into the global bond sell off.” – bto: was allerdings auch andere Gründe haben kann, vor allem das Bedürfnis der Marktteilnehmer, etwas Volatilität zu erzeugen.

- “We conclude that headline inflation will continue rising in the bloc as a whole during 2017. But this seems to be mainly the result of changes in commodity prices. (…) So far, a clear upward break in core inflation, compared to the average of the last few years, is conspicuously missing from the data. Global reflation is happening, but it is still fairly weak and patchy.” – bto: Solange es eben von Rohstoffen abhängt und wir zugleich mit Überkapazitäten, Zombies und Überschuldung zu tun haben, kann es nicht verwundern.

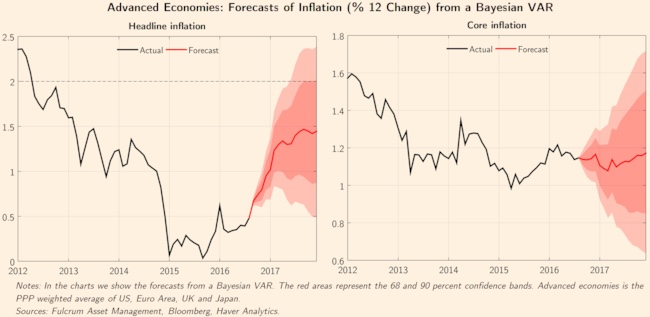

- “The forecasts are taken from models estimated by Juan Antolin Diaz and his team at Fulcrum. They are based on Bayesian VAR models, focusing on dynamics in core and headline inflation, and especially on the impact of oil prices and exchange rates, which tend to dominate short term movements in inflation data. (…) The latest forecasts produced by the models are as follows:”

Quelle: FT

- “The projections envisage a further rise in headline inflation to about 1.5 per cent by mid 2017. Although this would probably result in a further decline in deflation risk premia in bond markets, it is important to note that the inflation rate would still be far below the target of about 2 per cent that is the stated objective of the central banks.”

- “The US and the UK are the countries that are clearly taking the lead in injecting some inflationary impetus into the global economy. (..) These inflationary pressures relative to target are however entirely absent in the Eurozone and, especially, Japan. (…) The central banks in these two economies still have a lot more work to do.” – bto: oder auch nicht. Es zeigt doch eher, dass die Geldpolitik nicht wirkt. Sie kann nur versuchen, dass Vertrauen in Geld zu zerrütten. Und das wäre dann nicht eine Inflationsrate von zwei Prozent.

-> FT (Anmeldung erforderlich): “Global reflation: still weak and patchy”, 30. Oktober 2016