… doch eher Italien?

Frankreich, Portugal – oder doch Italien? Bekanntlich sehe ich in Italien die größten Risiken. So wohl auch die Autoren dieses Beitrages, die nochmals die Lange des Landes zusammenfassen mit Blick auf das Referendum zur Verfassung im Herbst. Mittlerweile eine Volksabstimmung zum Euro und zur Politik des Premiers Renzi:

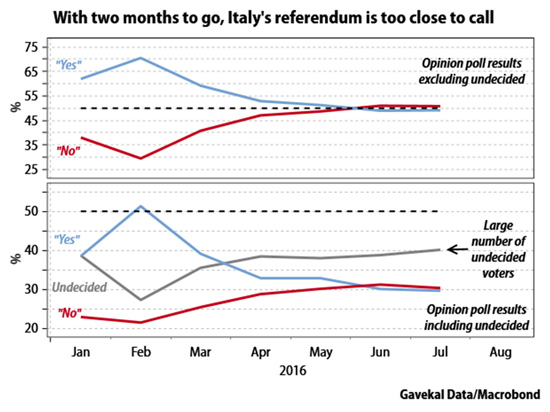

- “If he loses, Renzi has promised to step down – a pledge that has turned the referendum into a popular vote of confidence in the unelected prime minister, his Europhile policies, and by extension Italy’s membership of the eurozone itself. As a result, a ‚No‘ vote in October will not just precipitate the fall of Renzi’s government; it could throw Italy’s long term membership of the eurozone into doubt, plunging the single currency area once again into crisis.” – bto: Davon kann man ausgehen, und weil das so ist, werden Berlin und Brüssel alles tun, damit es nicht passiert. Renzi kann also auf “Erfolge” hoffen.

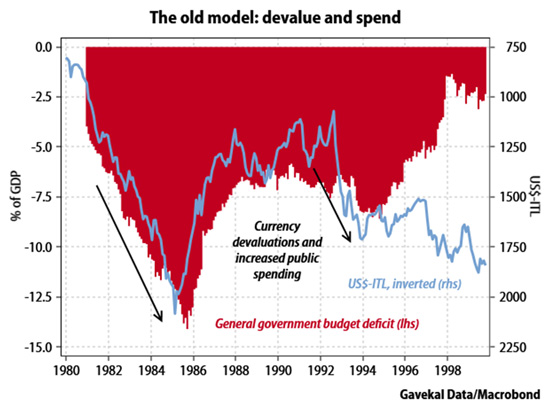

- “Its old economic model, in place for much of the last three decades of the 20th century, relied on a combination of currency devaluation to maintain international competitiveness together with fiscal spending to support the poorer regions of the country’s south.”

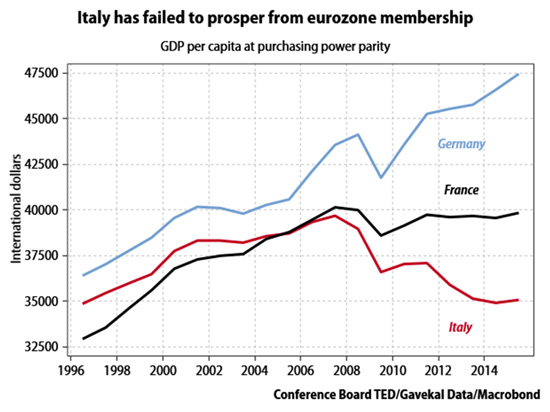

- “Signing up to the euro put an end to all that, preventing devaluations and prohibiting budget deficits at 10% of gross domestic product. (…) The result has not just been depressed growth and relative impoverishment, but an outright decline in living standards, as Italy’s real GDP per capita has slumped to a 20-year low.” – bto: Das ist schon beeindruckend.

- “Such a below-par economic performance has led to a build-up of bad assets on the balance sheets of Italy’s banks, where 18% of all loans are now classed as non-performing. In turn, this bad loan overhang has eroded the ability of the banking sector to extend new credit to the thousands of small businesses which are the engine of Italy’s economy and which normally power employment growth. The result is stagnation.” – bto: an der natürlich noch viele andere Ursachen Schuld sind! – auch die Demografie.

- “(…) Italy needs to enact wholesale structural reforms to enhance its competitiveness relative to its eurozone neighbors. Notably, it needs to make the labor market more flexible to encourage job creation, it needs to lower the barriers to entry that protect much of the country’s service sector, it needs to overhaul a judicial system so sclerotic that bankruptcy proceedings can last 10 years or more, and it needs to restructure its fragmented and dysfunctional banking system.” – bto: na dann viel Spaß! Wie soll das gehen?

- “Renzi’s referendum aims to change that. The prime minister is seeking popular approval for constitutional reforms that promise to cut the size of the upper house from 315 to 100 senators. (…) Most importantly, it will downgrade the political power of the Senate so that it will no longer be able to obstruct government legislation entirely, but only to propose amendments that will be adopted at the discretion of the lower house. The objective is to increase the executive power of the government (…).” – bto: verständlich.

- “The chances of a ‚Yes‘ vote in the referendum have not been improved by the slump in Renzi’s personal popularity following last year’s attempt to reform the labor market, and a series of small bank restructurings that saw retail savers “bailed-in” – forced to take losses – under new European Union banking regulations.” – bto: weshalb er um jeden Preis ein erneuten Bail-in verhindern will.

- “If Renzi loses the referendum, not only will Italy remain in policy limbo, but it is highly likely his subsequent resignation will trigger a parliamentary election. Under new election laws passed last year, if a party fails to win 40% in the first round of voting, the top two parties go through to a second round. The latest opinion polls put Renzi’s governing PD party on 31% and the 5-Star Movement on 29% (…).” – bto: Und wie wir in England gesehen haben, können die Umfragen sich irren.

- “At the moment, an election victory for the 5-Star Movement, which identifies as neither left nor right, appears at least as probable as a second round win for the PD. (…) Its broad stance is anti-establishment and in favor of direct participatory democracy rather than representative democracy, which it regards – with some justification in Italy – as an invitation to corruption.”

- “(…) in the event of a ‚No‘ vote in October, the only economic choice for Italy would be between continued stagnation, or a return to the old economic model of successive devaluations. The latter course would naturally mean exiting the eurozone anyway. But even if Italy were to take that path, it would hardly be a less painful way to restore the economy to health. Whether inside or outside the single currency, Italy still needs structural reform to ensure future growth.” – bto: Ja, aber das ist politisch weniger gut zu verkaufen.

- “Italy is the wider eurozone in microcosm. In the EU as a whole, progress towards creating the political and economic institutions that could ensure the success of the single currency project have been comprehensively obstructed by narrow – but deeply entrenched – national interests. This failure to advance, and the economic hardships and sense of disempowerment that have resulted, has fueled the rise of populist political parties from Greece to Finland – parties that are challenging an increasingly distrusted political elite and questioning not just the status quo, but the whole European project. If Renzi wins come October, the eurozone has fresh hope. But if he fails, Italy fails, and very likely the eurozone fails too.” – bto: yep.