Chinas “Dead Money” Trap

China war schon länger kein Thema mehr bei bto. Nicht, weil alles paletti wäre, sondern weil es im Sommer weniger Nachrichten gab.

Zur Erinnerung diese drei wichtigen Beiträge zu China auf bto:

→ China: Wirklich Schuldenwirtschaft nach westlichem Vorbild

→ Wie China Deflation exportiert

→ „Deflationärer Schock aus China trifft Anleger weltweit“

→ An China hängt die Weltwirtschaft

Auch haben wir an dieser Stelle schon die Parallelen zwischen China und Japan diskutiert:

→ Warum China um 21 Prozent wachsen muss, während die Demografie zuschlägt

Nun berichtet Ambrose Evans-Pritchard über die Bemühungen Chinas das Schlimmste noch abzuwenden:

- “China is at mounting risk of a Japanese-style ‚liquidity trap‘ as monetary policy loses traction and the economy approaches credit exhaustion, forcing a shift towards Keynesian fiscal stimulus. (…) Sheng Songcheng, the PBOC’s head of analysis, set off a storm last month by warning that the economy had ‚started to show some signs of being caught in a liquidity trap‘.”

- “The powerful State Council has now joined the chorus with calls this week for a $75bn cut in business taxes to boost confidence and channel stimulus to the productive economy.”

- “Chinese companies are hoarding record sums of ‚dead money‘ rather than spending it. The growth rate of private investment has dropped to 2.1pc over the last seven months, the lowest since global financial crisis.” – bto: ja, willkommen im Klub. Es gibt viele gute Gründe nicht zu investieren in der heutigen Zeit.

- “While the term ‘liquidity trap’ is loosely used, it has menacing echoes of the Great Depression, and has plagued Japan on and off for fifteen years.”

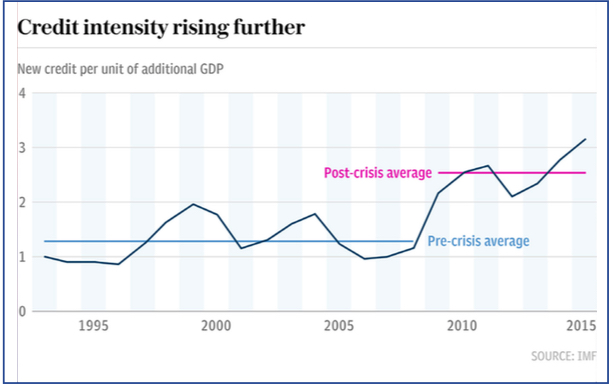

- “(…) Oxford Economics said credit expansion is achieving ever less ‚bang for the buck‘ as money floods into real estate speculation and financial assets (…) it took 44 yuan to generate 100 yuan of gross fixed capital formation from 2002 to 2008. This rose to 62 last year. It is now running at 70.

Quelle: The Telegraph

- “The International Monetary Fund earlier this month that corporate debt has reached 145pc of GDP. ‚Vulnerabilities are still rising on a dangerous trajectory. They must be addressed immediately‘, it said.”

- “The financial system is clearly out of kilter. The outstanding stock of mortgages has jumped by 30pc over the last year alone to $2.5 trillion, crowding out the credit market. Net new loans to businesses contracted in June for the first time in eleven years.” – bto: klares Zeichen für die unproduktive Verwendung der Mittel.

- Es gibt aber auch optimistische Stimmen, dass das noch eine Weile gut geht: “Simon Ward, a monetary expert from Henderson Global Investors, said there is nothing to fear. The surge in M1 is a sign that companies and consumers are shifting money into their accounts in order to spend it, and this will cause economic growth to pick up yet further over coming months.”

– bto: Fazit: Entweder China macht weiter mit dem schuldenfinanzierten Wachstum oder wir alle bekommen Probleme.