“Beware the zombies behind the world’s productivity problem”

Die Fakten zum Produktivitätswachstum sind ernüchternd. Hier die Zahlen vom Conference Board:

→ Conference Board: “Rebound in Global Productivity Growth Not in Sight”, November 2016

Ein wesentlicher Grund für das geringe Produktivitätswachstum sind die ungelösten Probleme der Vergangenheit, namentlich die Zombies: Unternehmen, die nur noch die (tiefen) Zinsen bezahlen können, aber nicht investieren und innovieren. Damit tragen sie nicht nur direkt zu dem geringen Produktivitätswachstum bei, sondern vergiften auch gleich das Geschäft für die anderen Akteure im Markt. Die FT fasst das schön zusammen:

- “Without productivity improvements, other economic problems will be harder to solve, as even the best policies will, to some extent, amount to zero-sum games and therefore butt up against greater political resistance. When productivity grows faster, it is easier to spend on needed causes with less sacrifice from taxpayers, and to compensate losers from necessary reforms.” – bto: Das ist so simpel wie einleuchtend.

- “(…) productivity growth is not stuttering everywhere in the economy. In fact the best “frontier” companies are increasing their productivity as fast as before the financial crisis. The disappointing economy-wide productivity figures are to be blamed on the companies that are behind the frontier, and which seem to have got worse at picking up best practice from the productivity leaders – bto: Ja, weil sie es nicht können.

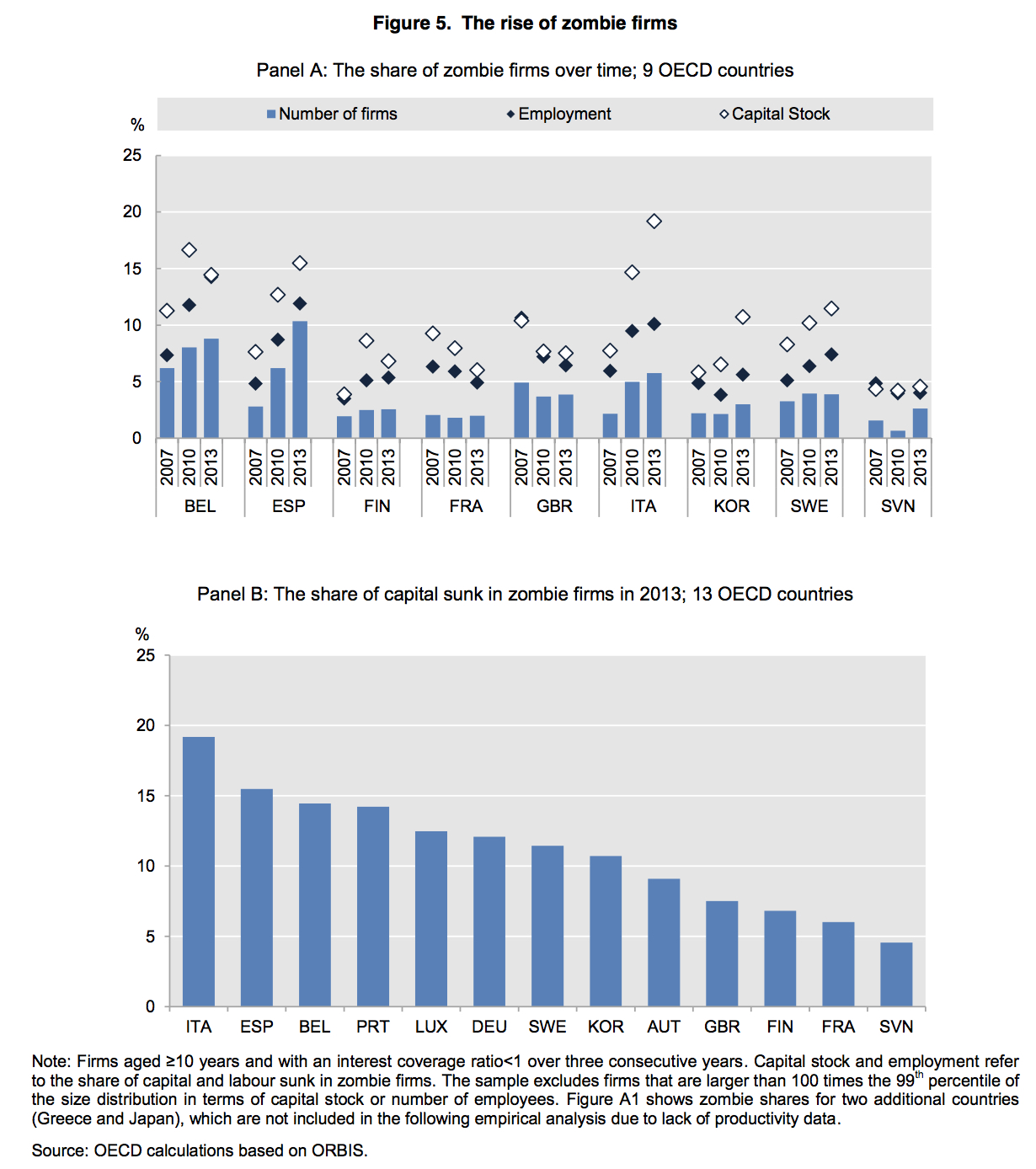

- “(…) what is at work are zombies! By ‚zombies‘ are meant companies whose regular revenues at most cover their interest expenses (if that). The OECD researchers find that such zombies take up a frighteningly large part of the economy. Across the nine European countries they studied, the share of the total private capital stock ‚sunk‘ in zombie companies ranges from 5 to 20 per cent.” – bto: Das ist deutlich mehr, als ich gedacht hätte.

- “Why have zombies proliferated to such an extent? Awful economic growth environments are a big part of the cause, of course (Italy has the biggest zombie problem of the countries examined). (…) The answer must be forbearance by creditors — typically banks that decide not to foreclose on bad loans.”- bto: weil die Banken sonst Pleite wären!

- “Critics of loose monetary policy often complain that low interest rates have allowed bad businesses to stay in business. This is, at best, half-true. (bto: Hätte ich auch gedacht.) (…) It is not the cost of borrowing that is at fault, but creditors’ willingness to tide over debtors who can barely meet even record-low interest service, let alone pay back the money they have borrowed. And the cause of that, in turn, is that governments have refrained from forcing banks to write down more decisively their own exposures to zombie companies.” – bto: Dann würde die völlige Überschuldung für alle deutlich.

bto: Und so vergiften die faulen Zombie-Banken mit den Zombie-Unternehmen das wirtschaftliche Umfeld, das ohnehin schon unter Druck ist durch andere Faktoren.

Und hier der Link zur OECD-Studie:

→ “THE WALKING DEAD? ZOMBIE FIRMS AND PRODUCTIVITY PERFORMANCE IN OECD COUNTRIES”, 10. Januar 2017