Alles wird gut …, zumindest vorübergehend

Wir wollen uns die Sommer-Laune doch nicht verderben lassen. Auch bei bto nicht! Deshalb die guten Nachrichten von der Weltwirtschaft. Die globale Geldmenge steigt so stark wie schon lange nicht mehr. Klarer Vorbote einer – vorübergehenden – Erholung. Übersetzt könnte man auch sagen: Die Schulden wachsen wieder schneller und helfen uns, die Last der bestehenden Schulden zu bewältigen! Ambrose Evans-Pritchard berichtet im Telegraph:

- “Global economic growth is accelerating sharply after months in the doldrums, confounding predictions of a worldwide recession following Britain’s Brexit vote.” – bto: Es ist die Fortsetzung der alten Politik und keine Lösung.

- “The US Federal Reserve’s retreat from four rate rises this year has had a catalytic effect, reviving the fortunes of emerging markets and once again lifting the Sword of Damocles hanging over the heads of those who have borrowed $11 trillion in dollars outside US jurisdiction.” – bto: was wiederum keine Lösung, sondern eine Verschleppung ist.

- “The Fed is in effect acting as the central bank for the whole world, giving a shot in the arm to an international financial system that is has never been so tightly-linked to the dollar or to US borrowing costs – at least since the end of the Gold Standard.” – bto: Die Fed scheint dies auch zu akzeptieren.

- “The Japanese are launching a giant fiscal package – in theory 5.7pc of GDP – while France, Italy, and other eurozone states have taken advantage of the Brexit scare to end austerity more quickly than planned and to prime pump their economies.” – bto: ja. Wir machen endlich mehr Schulden. Macht den Irrsinn unseres Systems offensichtlich.

- “The biggest shifts in the Fulcrum model are in Latin America and above all China, on track for blistering growth of 7.8pc in the third quarter as the country’s reflation blitz finally gains full traction. The official Chinese data almost certainly overstates the actual level of growth but proxy indicators used by banks and private analysts also point to a powerful recovery.” – bto: Wer jetzt nicht so euphorisch werden möchte, kann ein paar Beiträge zu China bei bto lesen.

- “Capital Economics warned that the latest boom is built on rickety foundations and living off “borrowed time”, but there is enough spending in the pipeline to keep the expansion going into next year.” – bto: eben Verschuldungsboom nach westlichem Vorbild.

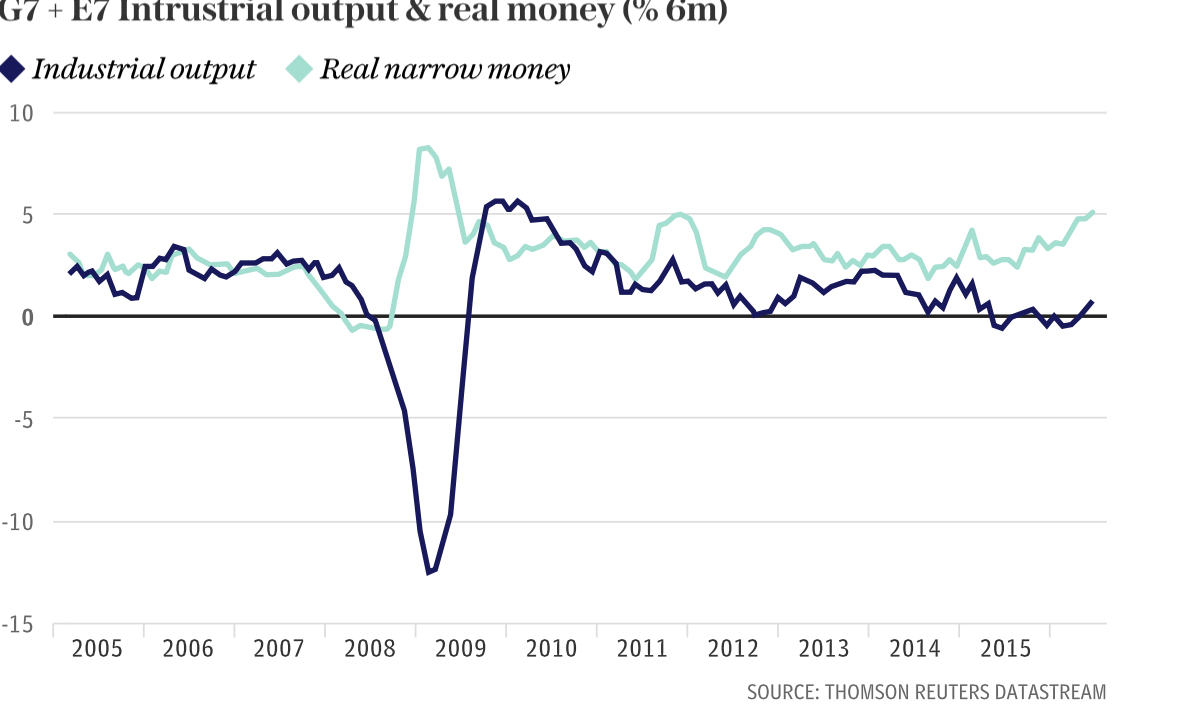

- “Data from Henderson Global Investors paints a similar picture. Its proprietary gauge – six-month real M1 money – shows the fastest growth since the post-Lehman stimulus in the biggest G7 and E7 developed and emerging market economies.”

- “The indicator measures cash and checking accounts, giving advancing warning of likely spending over the next few months. While monetary signals may have lost some of their potency in the modern the financial system, they often catch economic turning points.”

- “Much can go wrong as the Fed tries to navigate the reefs through the eighth and ninth years of what is already an ageing global cycle. The irony of Brexit is that it has led to so much precautionary stimulus that it may cause the US to overheat sooner rather than later, and force the Fed to slam on the brakes.”

“But let the world first enjoy the sunlit uplands for a few happy months.”

– bto: bevor wir von noch höherem Schuldenniveau in die nächste Krise steuern.

→ The Telegraph: “Surging world growth makes a mockery of Brexit panic”, 2. August 2016